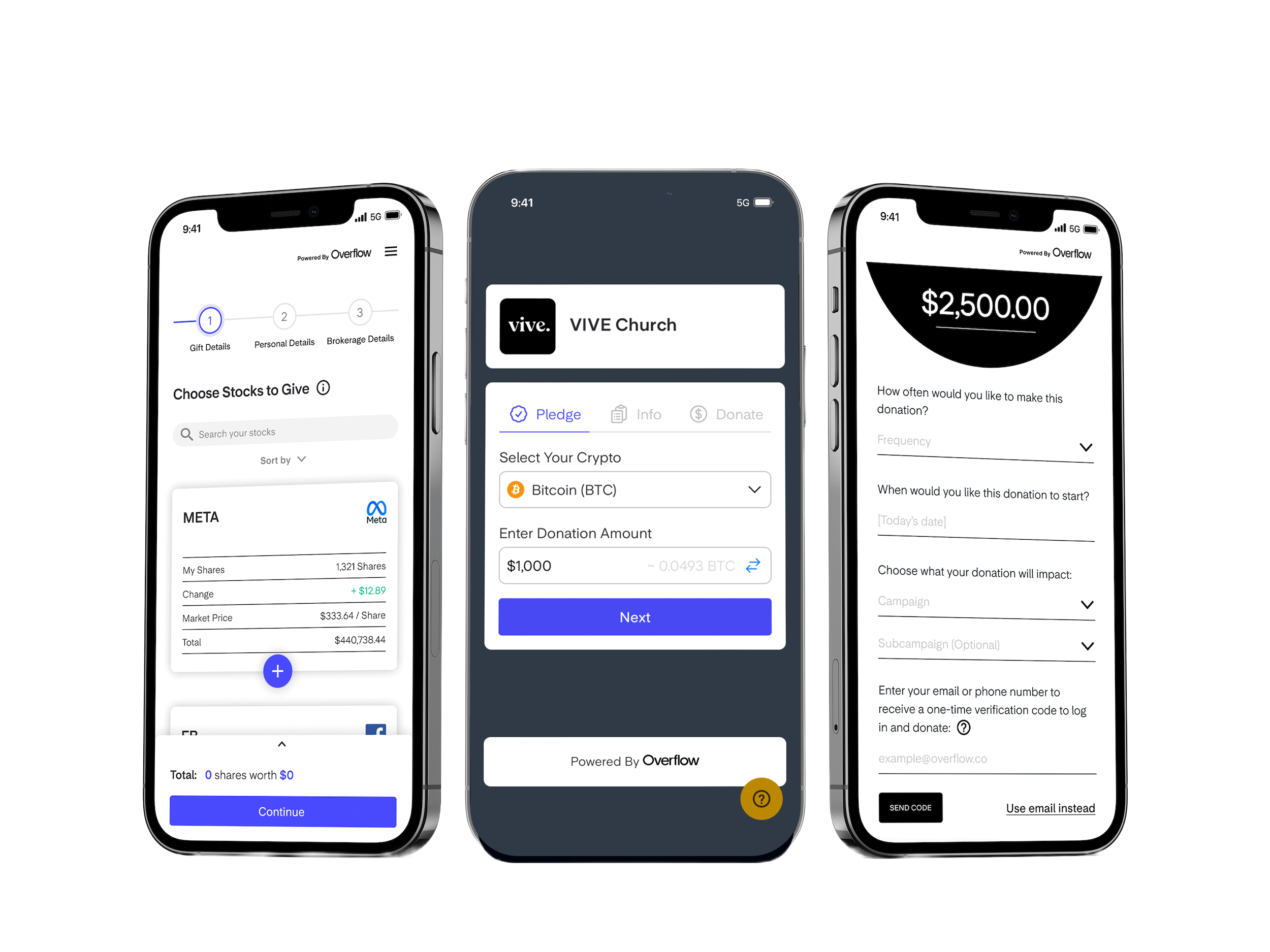

Donors initiate these gifts in minutes online instead of taking weeks offline.

Join hundreds of nonprofits in reinventing the way the world gives. Fill out this form to start a conversation with an Overflow team member, and get your questions answered.

Quick & Easy to Use

Secure Platform

SOC-2 Type 2 with ongoing penetration testing to keep donors and nonprofits safe.

Expert Support

Real people dedicated to supporting nonprofits and donors to facilitate non-cash giving.

.jpeg)

Transparency at Every Step

Ability to track donor details, gift status, and compliance in order to steward and cultivate your supporters.