Gifting Stock Starts Now: How To Be Prepared For December In July

With fears of a recession on the horizon, the US stock market has continued to tumble. The general sentiment of investors has slumped too. So it’s no surprise that many are looking to sell their assets before they dip even further. But, rather than making a loss through selling stock, you can instead opt to donate to charity by gifting stock.

.png?width=1100&name=Gifting%20stock%20to%20nonprofits%20%20(2).png)

Gifting Stocks Rather Than Selling At A Loss

Donating stocks gives you the unique opportunity to make a difference beyond your nine to five, even more so than if you were to donate to charity directly. Gifting stocks can be an incredible way to support worthy non-profits’ during their most pivotal season of the year, known as their Year-end.

Most nonprofits run Year-end campaigns, where they’ll appeal to donors in supporting their annual goals. These can be very much make-or-break in the success of a charity. As the name suggests, most Year-end donations take place in December. However, gifting stock can be an incredible way of being better prepared during this crucial time of year.

Traditionally, individuals might have sold their stocks and then would donate this cash to a charity. However, when gifting stocks directly to nonprofits, real wins can be seen all-round (for both you and the nonprofit).

A key benefit being the tax savings of directly gifting stocks. If choosing to liquidate stocks, to then donate to charity, the donation can be taxed through capital gains tax by up to 37%. Yet, capital gains are protected when gifting stock. This, in effect, means that your donation will be larger than if you were to liquidate your assets first, with greater tax savings.

If you were to sell your stocks at a loss, rather than gifting stock, you’d lose out on these tax advantages. When donating your stocks and shares, you’d benefit from a greater tax write-off at the market value of your stock when donated, no matter the original stock price.

.png?width=1100&name=Gifting%20stock%20to%20nonprofits%20%20(1).png)

Make A Difference, Donate To Charity

Through these double-wins via gifting stock, you’re able to better the impact of your donations. With capital gains protected even with larger donations, worthy causes will feel the benefit of your giving more so. It's no surprise that the average donation to nonprofits, via Overflow, is approximately 50 times greater than the average online donation (through ACH, debit, or credit). Yep! These larger donations can be significant in supporting Year-end campaigns, where nonprofits will often focus their efforts and their key performance indicators.

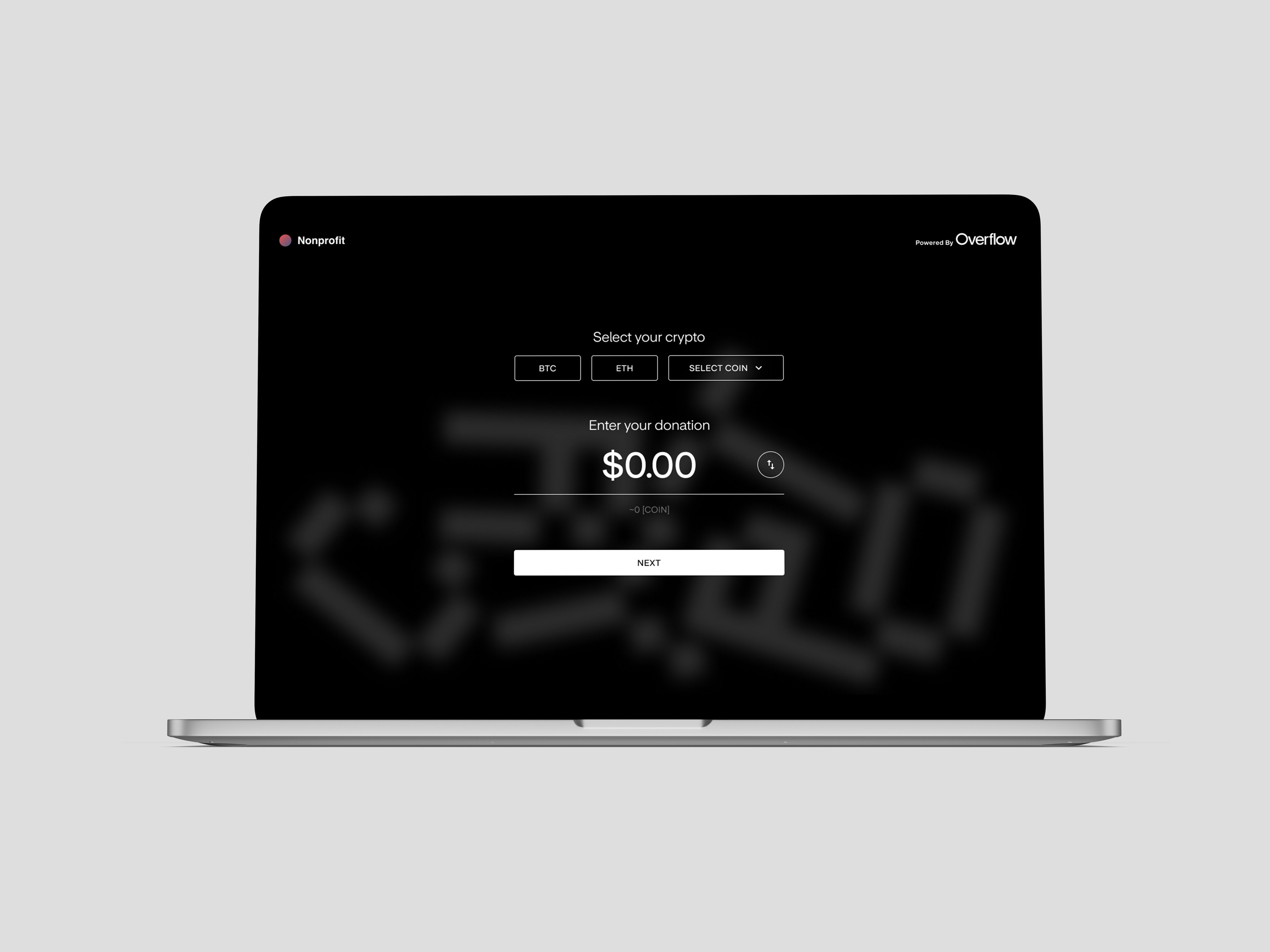

Nonprofits’ Year-end campaigns also bring endless streams of paperwork when collecting donations (for both charities and donors!). But by gifting stocks through Overflow, we ensure that the donation process is seamless. With Overflow, you’re able to seamlessly manage and keep tabs on all of your donations, via our Nonprofit Dashboard.

During the busy giving seasons, you’re able to be an effective and organized donor; but also prepare and manage donations, well in advance of Year-end campaigns.

With opportunities to increase the significance of your donations, as well as better managing these during busy Year-end seasons, it's no wonder that many have chosen to opt for gifting stocks through Overflow.