As the stock market shows promising potential and with crypto wallets gaining momentum, many Americans are considering the benefits of gifting these valuable assets as the year draws to a close.

In fact, Elon Musk is thought to be funding another crypto to rival Bitcoin amid its price crash. But for NPOs, NGOs, and charities across the U.S., this means one thing. It’s time to make it easier than ever for donors to give assets, stock, and crypto, especially as we move into Q4.

So, grab a coffee, and let’s talk about gifting stock donations in the run-up to Christmas.

Stock Donations Are An Increasing Trend Among Donors

With 10 million givers in the U.S. donating $50 billion a year to churches and nonprofits, it’s clear how financial support can help organizations fund and launch projects and campaigns to protect the planet and improve the lives of millions of people around the world. But, as more tithers invest in stock, assets, and crypto, nonprofits and church leaders must focus on facilitating non-cash donations in 2023 and 2024.

Increasing your stock donations in Q4 comes down to 3 key factors: placement, education, and timing. So, let’s delve into each one.

1. Placement matters

What most nonprofit fundraisers don't know about stock donations is that most people don’t give stock, not because they do not hold assets, but because they are unaware of how tax-advantageous stock donations can be. But that’s where Overflow comes in.

We have some actionable tips on how you can maximize your stock donations by the end of the year. So whether your donors are young professionals, community leaders, or thinking of retirement, here’s how to make their life easier when it comes to donating digitally and in particular via stocks.

59% of Gen Xers donate when inspired by a social media campaign, and 24% of baby boomers tend to give online as the result of direct mail. That means marketing is critical when promoting your cause, and if the online experience of donating is time-consuming, challenging, or counter-intuitive, chances are donors will become disinterested and forget about gifting. If you factor in someone completely new to giving, your chances of securing support are quite low.

Imagine that a donor, let’s call them Taylor, just watched an incredible video on your homepage about how your organization is helping the homeless find local food banks. Taylor is inspired, feels the urgency of your organization’s mission, and wants to donate.

Taylor is fortunate enough to have worked at Tesla for the last few years, and not only is she in the position to donate, but she has the flexibility to donate through cash or stock.

To help ensure that Taylor donates to your organization in the way that works best for her, make sure your giving options are obvious and easy to find.

A placement that is obvious and easy to find for stock donations is even more important, as most donors might be unaware your organization even accepts stock in the first place.

Stock donations are a high-value gift, beneficial to both the donor and the nonprofit. The proof is in the numbers. $128 is the average online donation amount given in one single donation. Whereas the average stock donation through the Overflow platform is over $10,000.

Crazy, right? Don’t miss out on potentially larger gifts by hiding this information at the bottom of your “Ways To Give” page.

2. Educate, then activate

If you have fundraised for stock gifts before or have even donated yourself, it is probably because you are aware of the significant tax advantages that donating stock can have when compared to cash.

Unfortunately, these are still not well-known for most donors. This is why it is so important to educate your supporters on why you support this high-value way of giving. We recommend placing educational content recommending stock donations on or near your organization’s Donate Page.

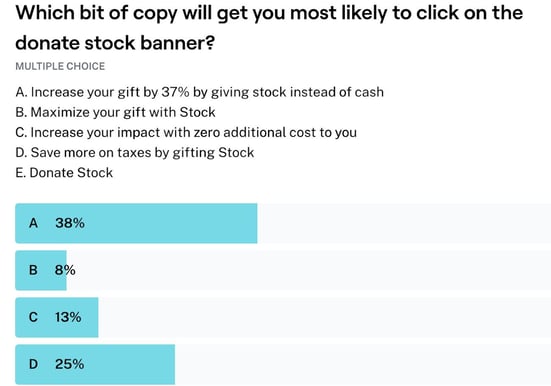

Check out this study below - we asked participants what copy would entice them to donate stock, and the majority would be swayed by understanding the tax saving benefits of their donation.

Donating stock after it has appreciated in value for a year allows you to deduct the full fair market value from your taxes and protects your realized gains from being subjected to long-term capital gains tax, which can be up to 20% of the gains.

Sometimes, creating a narrative can help illustrate your point and appeal to donors.

For example:

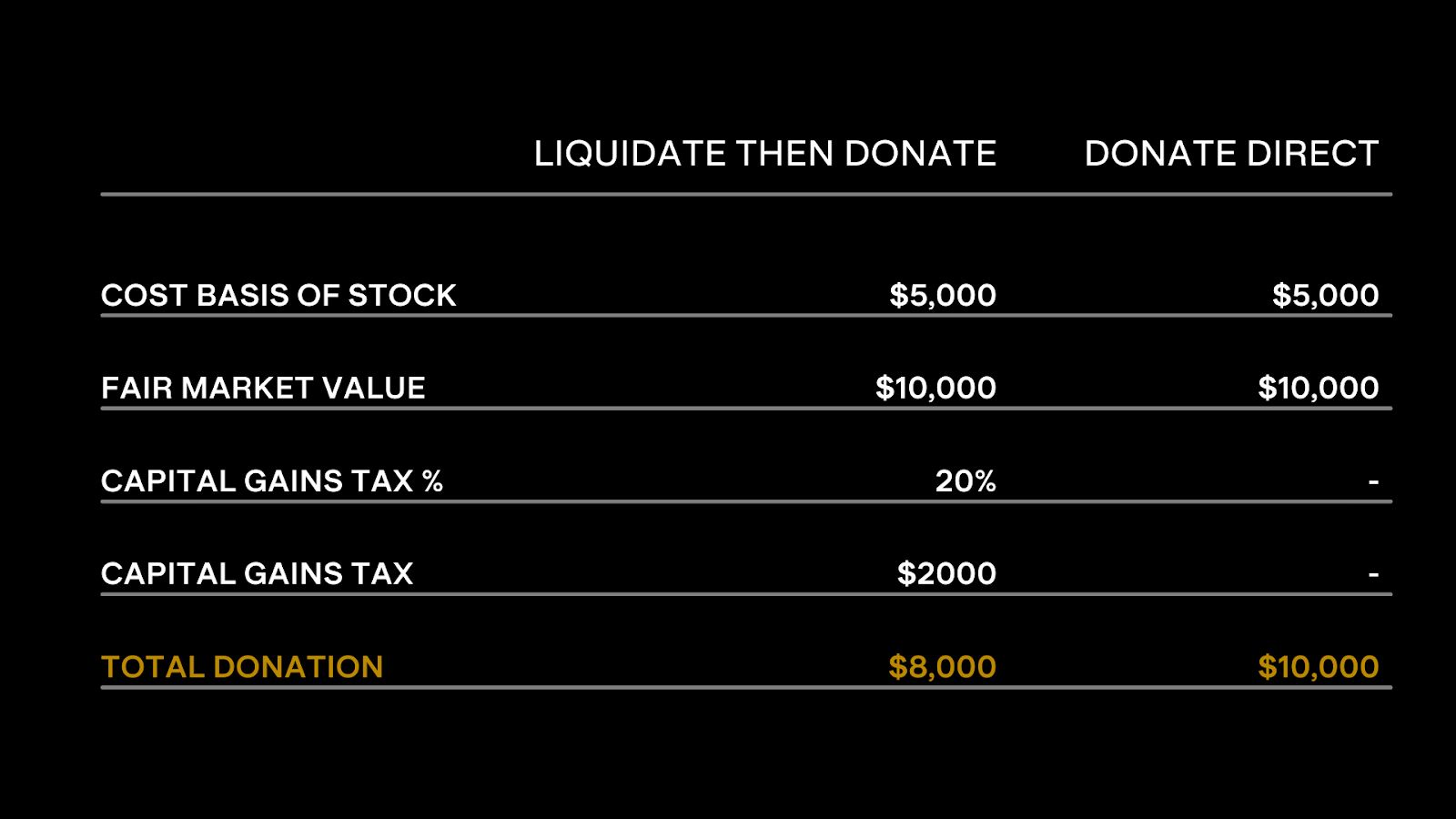

Let’s say that generous donor Taylor initially purchased stock a year ago for $5,000. Over the last year, her stock has appreciated in value and is now worth $10,000.

She now has two options if she would like to donate these assets:

- Sell the stock and donate the cash value

- Donate the stock directly to a nonprofit

If she were to sell the stock and donate the cash value, her donation would be subject to up to 20% capital gains tax, reducing the value she is able to donate by $2,000.

If she were to donate the stock directly to the nonprofit, her gift would be protected from capital gains tax, and she would be able to donate the full intended value. Not only that, but she would be able to take that entire fair market value deduction off her taxes.

Thus, by donating stock directly, Taylor would be able to:- Give a larger donation because capital gains are protected

- Claim a larger tax deduction because of the larger gift, so she would save more on taxes

To illustrate this example, take a look below:

Yes, telling a story takes up more real estate on your website, but the upside of being able to provide invaluable information as a potential donor progresses through their decision-making journey can ultimately lead to a higher-value donation for you and a better experience for the donor.

Set Up Donor-Advised Funds

By integrating a 'Donate via DAF' button on your website, you provide a gentle reminder to those with donor-advised fund (DAF) accounts to utilize them for charitable giving. Many individuals contribute to their DAFs, reaping the immediate tax benefits, but often overlook the substantial funds they've accumulated. In fact, there's an astonishing $234 billion in DAF accounts waiting to be directed towards meaningful causes. By prominently featuring a DAF donation option, you can tap into this reservoir of goodwill and encourage more consistent contributions to your charity or NPO.

3. Simplicity is everything

If a donor does make it to a “Give Stock” page, we’ve seen that many of these pages just provide a DTC number, a vague outline for a Letter of Instruction, and a contact number.

The longer it takes for donor Taylor to navigate from that inspiring video to your 'Other Ways To Give' page, the more her initial enthusiasm might wane. The realization that she has to email someone from your organization, locate the right Letter of Instruction, print, complete, sign, scan, and then fax it could be discouraging. This process might even delay her donation by days.

Honestly, I’m exhausted just thinking about that process!

We are so used to efficiency and things happening at lightspeed; even if Taylor does take the time to do all of these steps… would she do it again?

We’ve thought a lot about this here at Overflow, and it has informed how we crafted our entire online stock-giving ecosystem, from education to gifting to acknowledgment.

Take a look at our nonprofit page to see our offerings. If you want to learn more about how online stock donations could elevate your fundraising efforts and make it easier for donors to give these high-value assets to your nonprofit, book a demo with us.

References

1: https://www.forbes.com/advisor/investing/stock-market-outlook-and-forecast/

2:https://www.forbes.com/sites/digital-assets/2023/09/04/elon-musk-revealed-to-be-quietly-funding-crypto-rival-to-bitcoin-amid-price-crash/?sh=7146596517ba

3:https://nonprofitssource.com/online-giving-statistics/#:~:text=About%2010%20million%20tithers%20in,and%20not%20their%20net%20income.

4:https://nonprofitssource.com/online-giving-statistics/

5:https://nonprofitssource.com/online-giving-statistics/#:~:text=%24128%20dollars%20is%20the%20average,donation%20total%20for%20recurring%20donors.

6:https://www.nptrust.org/philanthropic-resources/philanthropist/make-a-charitable-impact-with-crypto-and-donor-advised-funds/