In this article we outline how nonprofits can increase their stock donations by the end of the year by utilising three key factors: placement, education and timing.

What most nonprofit fundraisers don't know about stock donations is that most donors don’t give stock not because they do not hold assets, but because they are unaware how tax-advantageous stock donations can be. In fact, a 2016 study by Fidelity Charitable found that 80% of donors own appreciated assets (like stocks, mutual funds, or bonds), but only 19% of this population has donated these assets to charitable organizations. Overflow is here to help change that and we have some actionable tips on how you can maximize your stock donations by the end of year.

1. Placement Matters!

We are so used to getting information upfront, that if it takes a donor more than a couple clicks to find out how to donate stock on your website, the likelihood of them actually converting to donate stock dramatically decreases - especially if this is a donor that has never donated before!

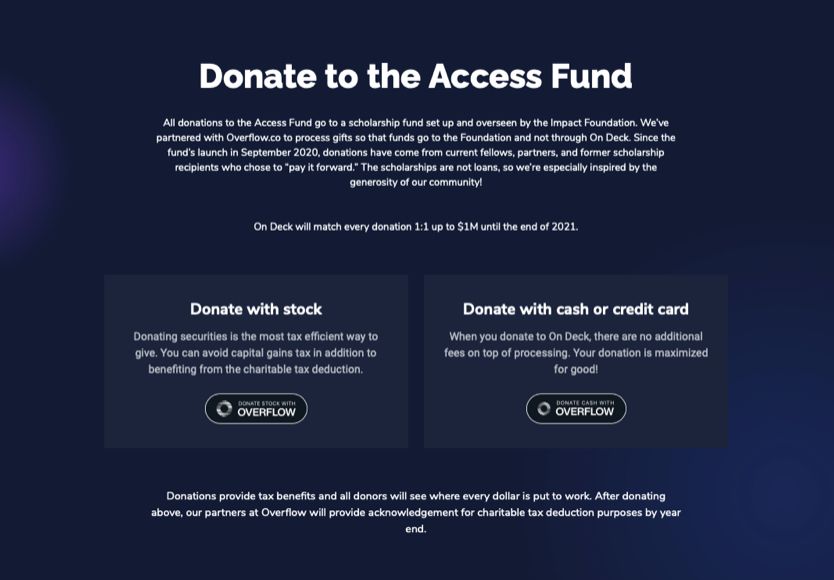

If your nonprofit accepts stock donations, this option should be right next to your other online donation options like cash and credit. The more time a potential donor has to spend digging through an “Other ways to give” page, the less likely they are to donate.

Imagine that a donor, Taylor, just watched an incredible video on your homepage about how your organization is helping people experiencing homelessness get vaccinated against COVID-19. Taylor is inspired, feels the urgency of your organization’s mission, and wants to donate.

Taylor is fortunate enough to have worked at Tesla for the last few years and not only is she in the position to donate, but she has the flexibility to donate through cash or stock. To help ensure that Taylor donates to your organization in the way that works best for her, make sure your giving options are obvious and easy to find.

A placement that is obvious and easy to find for stock donations is even more important, as most donors might be unaware your organization even accepts stock! Stock donations are a high-value gift, beneficial to both the donor and the nonprofit. The proof is in the numbers. The average cash donation in the U.S. is $128, whereas the average stock donation through the Overflow platform is $6,031. Don’t miss out on potentially larger gifts by hiding this information at the bottom of your “Ways To Give” page.

2. Educate, then activate

If you have fundraised for stock gifts before, or have even donated yourself, it is probably because you are aware of the significant tax advantages that donating stock can have when compared to cash. Unfortunately, these are still not well known for most donors. This is why it is so important to educate your supporters on why you support this high-value way of giving. We recommend placing educational content recommending stock donations on or near your organization’s Donate Page.

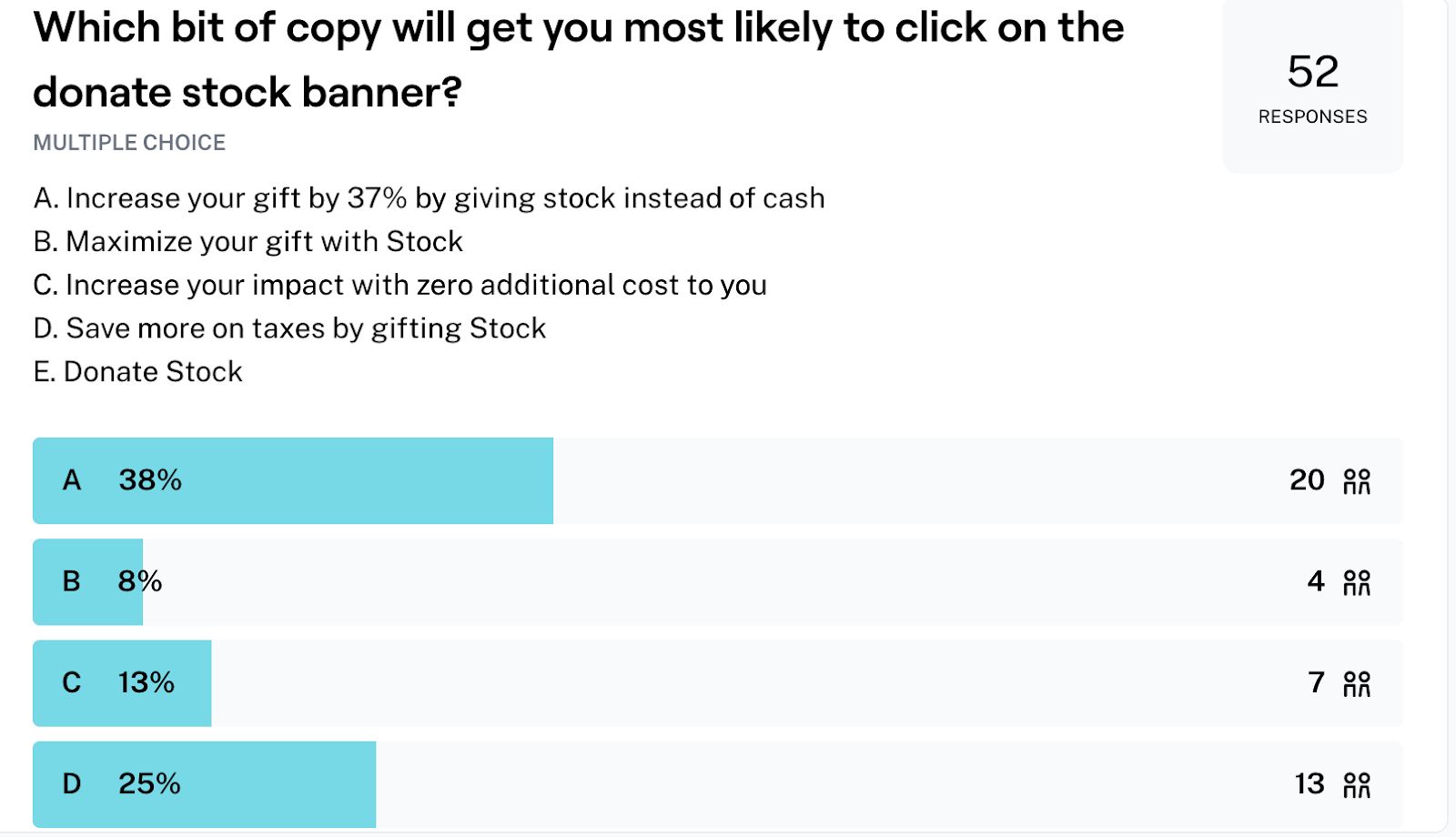

Check out this study below- we asked participants what copy would entice them to donate stock, and the majority would be swayed by understanding the tax savings benefits of their donation.

For example:

Donating stock after it has appreciated in value for a year allows you to deduct the full fair market value from your taxes and protects your realized gains from being subjected to long term capital gains tax, which can be up to 20% of the gains.

Sometimes, creating a narrative can help illustrate your point and appeal to donors.

For example:

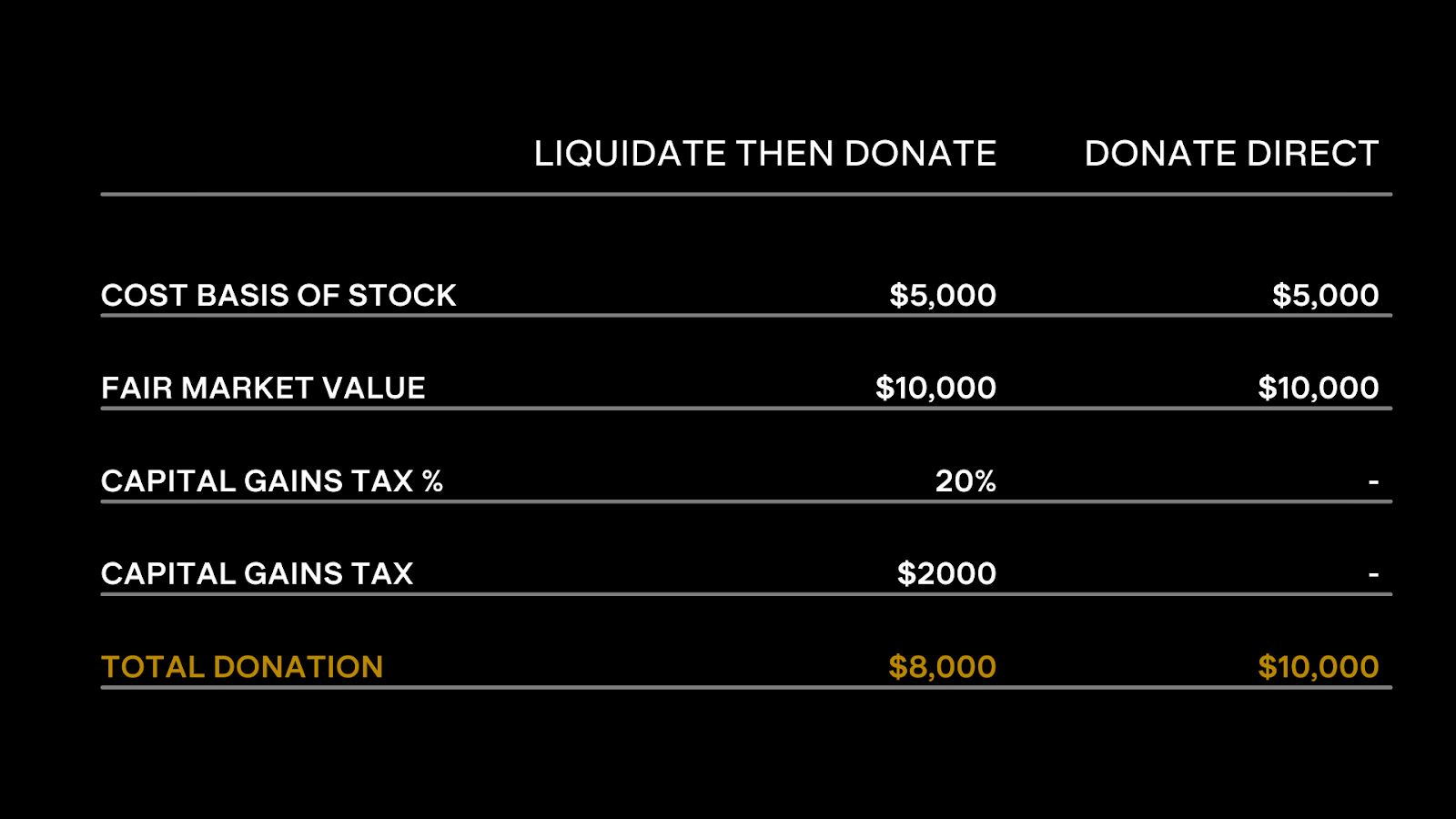

Let’s say that generous donor Taylor initially purchased stock a year ago for $5000. Over the last year, her stock has appreciated in value and is now worth $10,000. She has two options if she would like to donate these assets:

- Sell the stock and donate the cash value

- Donate the stock directly to a nonprofit

If she were to sell the stock and donate the cash value, her donation would be subject to up to 20% capital gains tax, reducing the value she is able to donate by $2000.

If she were to instead donate the stock directly to the nonprofit, her gift would be protected from capital gains tax, and she would be able to donate the full intended value. Not only that, but she would be able to take that entire fair market value deduction off her taxes.

Thus, by donating stock directly, Taylor would be able to:

- Give a larger donation because capital gains are protected

- Claim a larger tax deduction because of the larger gift, so she would save more on taxes.

To illustrate this example, take a look below:

Yes, telling a story takes up more real estate on your website, but the upside of being able to provide invaluable information as a potential donor progresses through their decision making journey, can ultimately lead to a higher-value donation for you, and a better experience for the donor.

3. Timing is everything.

If a donor does make it to a “Give Stock” page, we’ve seen that many of these pages just provide a DTC number, a vague outline for a Letter of Instruction, and a contact number. The time between when donor Taylor watched that inspiring video and is now deep in your Other Ways To Give page is growing and perhaps her desire to give is dwindling, as she realizes she now must email a contact at your organization for further giving instructions, find the correct Letter of Instruction from her brokerage, print the form, fill it out, sign it, scan it, and fax it to the correct receiving number.

I’m exhausted just thinking about that process.

We are so used to efficiency and things happening at lightspeed, even if Taylor does take the time to do all of these steps… would she do it again?

We’ve thought a lot about this at Overflow, and it has informed how we crafted our entire online stock giving ecosystem, from education, to gifting, to acknowledgement. Have a look at our nonprofit page to see our offerings. If you want to learn more about how online stock donations could elevate your fundraising efforts and make it easier for donors to give these high-value assets to your nonprofit, book a demo with us.