Loved by Top Churches

Churches have seen up to a 32x return on their investment with Overflow

Did you know that 90% of US wealth is in non-cash assets? If you're only accepting cash donations, you're missing massive giving potential. With Overflow, you can unlock new ways to give, and easily accept gifts of appreciated assets that are 78x larger than your average cash donation – in minutes, not months.

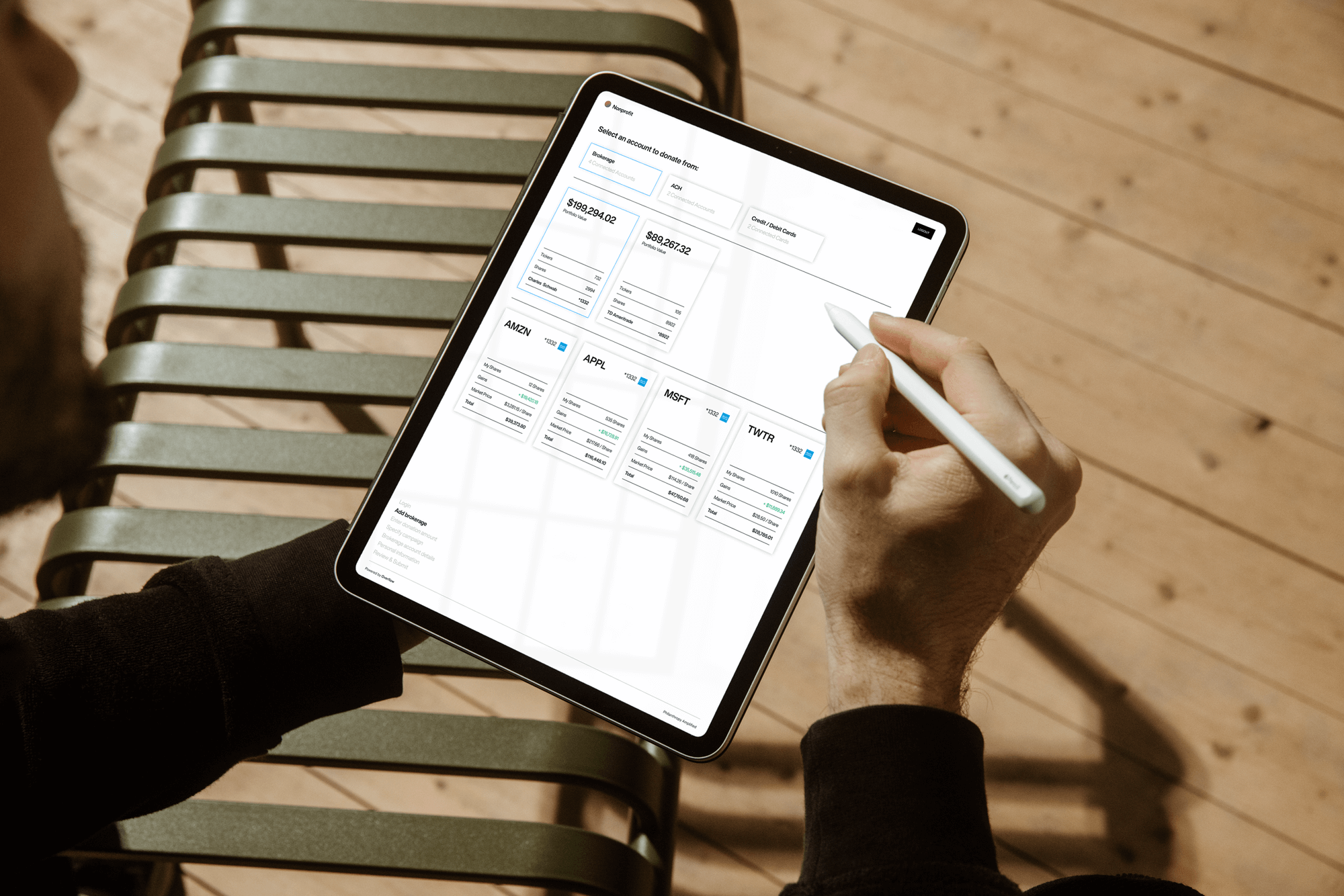

Our elevated and beautifully designed stock, crypto, and cash donation experience inspires big giving. The average online donation made through ACH, debit or credit is just $128...whereas the average donation through Overflow is $10,000! This is so much unrealized potential in non-cash giving, so now is the time to unlock new ways for your donors to give.

Streamline your giving processes with automation and expert partners you can trust.

Process and manage all of your gifts from our technically robust, yet easy-to-use, back office system.

We automatically generate gift acknowledgment letters for you that are IRS-compliant and customizable. Simply review and send with a click of a button.

Jumpstart stock and crypto gifts in less than a week with a team that is dedicated to your onboarding experience and help you encourage your members to participate in above-and-beyond generosity.

Access a team of experts that can readily answer you and your givers’ questions and ensure a smooth experience for everyone.

“Thanks for all the great work you all are doing to help make giving more seamless and easier, and for partnering with Reality SF.”

This team has played such a critical role in this entire process. I look forward to continuing to work with you all as we continue to grow! Again, thank you!"

"I wish [other payment providers] gave the same support as you guys. We do millions of dollars of transactions with them and don't get the same level of support. You are great!"

"The donated stock hit our account yesterday! I have confirmed in the dashboard and sent the [acknowledgement] letter."

Studies show that churches receiving stock and crypto are growing 55% faster than those that don’t. Because givers hold more wealth in stock and crypto than cash and they don’t rely on stock and crypto for day-to-day expenses, stock and crypto gifts are usually larger than cash gifts. The average gift through Overflow is $10,000, which is 100x larger than the average cash gift nationwide.

When a donor gives stock to a nonprofit, the donor and the nonprofit don’t have to pay any capital gains tax on the appreciated amount. Donors also receive a greater tax write-off at the market value of the stock upon donation, regardless of what they bought the stock for.

There are two key tax advantages for donors who give stock over cash:

501(c)3 nonprofits are exempt from capital gains tax. If a nonprofit receives a $100 stock and it eventually turns into $1000, the nonprofit can sell the stock and it will not be subject to capital gains tax on the $900.

Overflow is designed to be a simple and efficient way to donate stock to your favorite nonprofits. Its user-friendly platform provides donors and nonprofits with greater autonomy in how they give and receive stock donations. Overflow is in many ways complementary to a Donor-Advised Fund.

The main difference between DAFs and Overflow is that Overflow does not hold the donor’s stock in a separate account. Stocks donated via Overflow are transferred directly from the donor to the nonprofit’s brokerage. Notably, this distinction means that the donation is deployed instantly to the nonprofit, who can begin utilizing the funds without delay.

The donor transfers their shares to a DAF (this is considered a donation) and can be held in this fund until the donor directs a broker to donate it towards a nonprofit.

Overflow can facilitate stock donations to any registered 501(c)3 public charity that is in good standing with the IRS, such as local and global charities, churches, and universities.

A 501(c)3 is a charitable organization that is exempt from federal income tax under section 501(c)3 of Title 26 of the United States Code.