When giving you always want to maximize the impact of your donation to the charity or nonprofit you care about. A key way to unlock that impact is through stock donations. It’s the most tax-efficient way to give. In this article we outline how you can donate stock to maximize the value of your donation both the slow and fast way.

The Current Process of Donating Stock

For donors, donating stock is the most tax-efficient way of giving. But if you wanted to donate stock to a charity how would you go about this?

Let’s break it down:

- First, you will need to contact the nonprofit’s giving team to ask if they accept stock donations and their donation process. If they do, the nonprofit will provide you with their account information and brokerage number.

- Then, the nonprofit would need to contact their broker for their stock donation process forms. The forms can vary, so ensure you ask your nonprofits broker for advice on the full process.

- Once you have the forms you then need to print them out and fill them in. To ensure there are no errors you may need to follow up with the nonprofit to confirm their details.

- Send your charitable stock transfer form via mail or fax to the nonprofit’s brokerage to initiate the transfer. If the broker provides you a confirmation number, make note of it so you can reference the transaction in case any issues arise later on.

- The nonprofit receives its stock gift in its brokerage account. In most cases, it will be anonymous. Unless you have notified the charity of the donation.

- You will then receive a charitable acknowledgment letter for your records if the nonprofit was able to match their gift to the donor.

As you can see the manual method of donating shares can be tedious and time-consuming. It involves a lot of paperwork and constant back and forth between the donor and the nonprofit. Above all, it realised the actual necessity of mailing or faxing. This method of communication is still living in the 20th century.

There must be a faster way?

The Overflow Process of Donating Stock

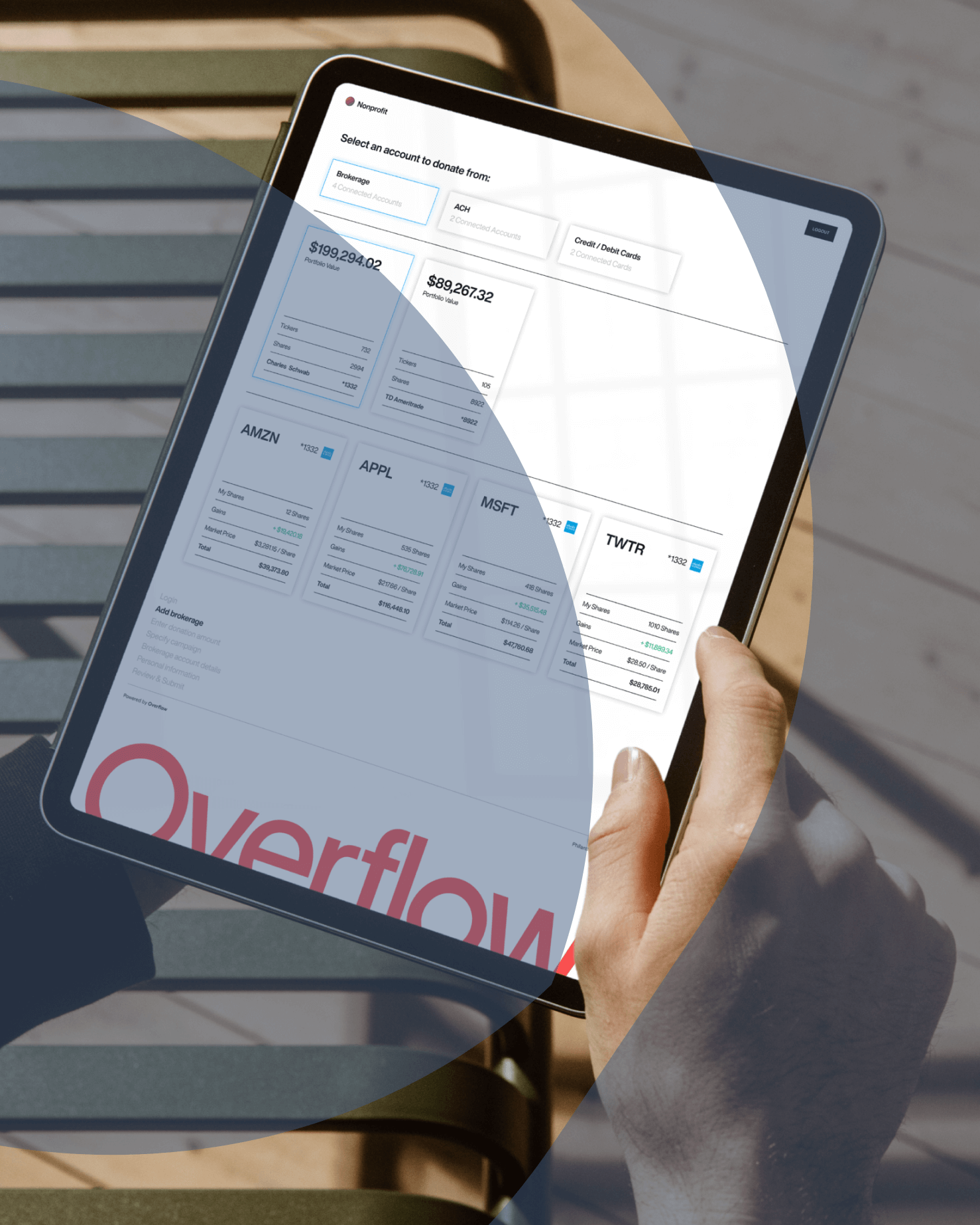

At Overflow we make donating stock frictionless through our secure portal. You can now donate stock in less than two minutes. Overflow is free for donors to use. Our partners include the likes of the World Food Bank, Tipping Point, Newstory and hundreds more!

Here is how it works:

1). If we have partnered with the nonprofit you will see the “Overflow” or “donate stock” button on their website.

2). Once you click on the button you will be directed to a secure and end-to-end encryption portal.

If you’re a first-time donor you will need to make an account to connect with your broker. It will take you less than one minute.

3). Select your broker and choose the share you want to donate. The transaction is then executed securely through our system. Without the need to print and send forms.

In less than 2 minutes you have donated your stocks to a nonprofit organization you care about.

Fast and frictionless.

The Benefits of Donating Stocks Directly for Donors

For the donor, donating stocks directly allows you to give more in value, make a bigger impact, and save money at the same time. In short, giving appreciated stocks directly to a nonprofit is up to 37% more tax-efficient than a cash donation. The reason being is that when you donate stocks directly to a nonprofit, neither the donor or the nonprofit will have to pay the capital gains tax on the donation. At the same time, you will receive the tax receipt for the fair market value at the time of donation. For example, if you want to make a $10,000 donation you have the option now to donate the value of that donation directly through stock to the nonprofit while you benefit from significant tax savings.

Donating stock may not be the first thing that most donors would consider when planning on making a charitable donation. But, giving stock to a nonprofit ensures you maximise the impact of your donation, whilst minimizing the capital gains tax implications. It is by far the most tax efficient way to give.

If you’re a non-profit organization and are interested in activating stock donations as a new fundraising channel - book a demo with our team!